Everything about Estate Planning Attorney

Wiki Article

An Unbiased View of Estate Planning Attorney

Table of ContentsNot known Facts About Estate Planning AttorneyWhat Does Estate Planning Attorney Do?Little Known Facts About Estate Planning Attorney.The 30-Second Trick For Estate Planning Attorney

Estate preparation is an action plan you can use to identify what happens to your assets and responsibilities while you're active and after you pass away. A will, on the other hand, is a lawful record that outlines how assets are dispersed, that deals with youngsters and pets, and any kind of various other dreams after you pass away.

The administrator additionally has to settle any type of tax obligations and debt owed by the deceased from the estate. Financial institutions usually have a restricted quantity of time from the day they were notified of the testator's death to make insurance claims versus the estate for money owed to them. Insurance claims that are denied by the executor can be brought to justice where a probate court will have the last say regarding whether the claim stands.

How Estate Planning Attorney can Save You Time, Stress, and Money.

After the stock of the estate has been taken, the worth of properties computed, and taxes and financial obligation paid off, the administrator will certainly then seek authorization from the court to disperse whatever is left of the estate to the recipients. Any type of inheritance tax that are pending will come due within 9 months of the day of fatality.

Each specific locations their possessions in the trust and names a person various other than their spouse as the recipient., to sustain grandchildrens' education.

Our Estate Planning Attorney Statements

This technique entails cold the value of a possession at its worth on the day of transfer. Accordingly, the read what he said amount of prospective resources gain at fatality is also frozen, enabling the estate organizer to approximate their potential tax obligation upon death and much better prepare for the settlement of income taxes.If adequate insurance policy proceeds are available and the policies are correctly structured, any type of revenue tax obligation on the regarded personalities of assets following the death of an individual can be paid without resorting to the sale of assets. Earnings from life insurance policy that are received by the beneficiaries pop over to this site upon the death of the insured are generally income tax-free.

There are particular documents you'll need as part of the estate planning procedure. Some of the most usual ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a misconception that estate planning is just for high-net-worth individuals. Estate intending makes it simpler for individuals to establish their wishes prior to and after they die.

Not known Details About Estate Planning Attorney

You ought to begin intending for your estate as soon as you have any measurable possession base. It's a recurring procedure: as life progresses, your estate plan ought to change to match your conditions, in line with your new objectives.Estate planning is commonly believed of as a tool for the affluent. Estate planning is also a fantastic method for you to lay out plans for the care of your small youngsters and family pets and to describe your desires for your funeral and favorite charities.

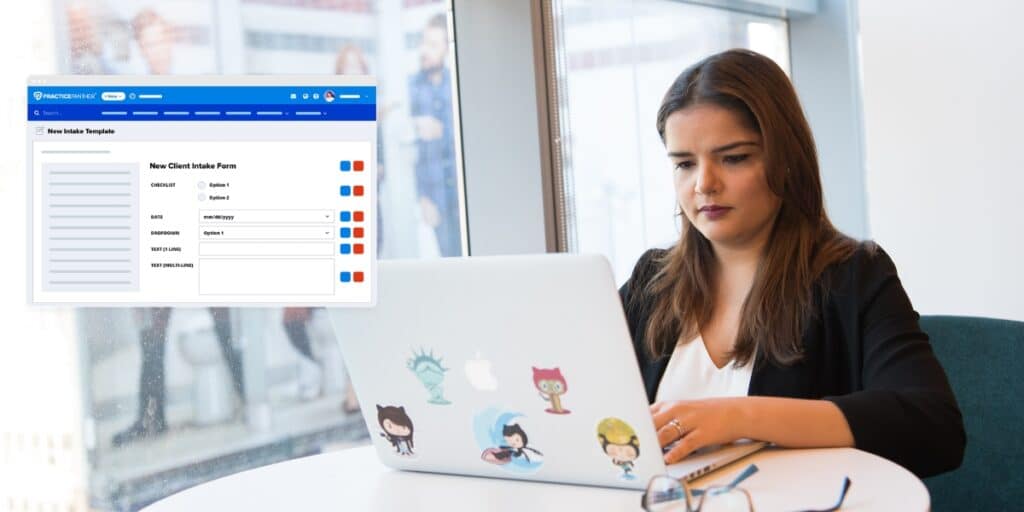

Applications must be. Eligible candidates that pass the test site link will be officially accredited in August. If you're qualified to rest for the exam from a previous application, you may file the brief application. According to the regulations, no certification shall last for a period much longer than 5 years. Figure out when your recertification application is due.

Report this wiki page